Mortgage Rates Just Dropped — What It Means for the Oklahoma City Market

Mortgage Rates Just Dropped — What It Means for Buyers, Sellers, and Homeowners in the OKC Market 📅 Posted April 2025 by Will Flanagan Realty Group Mortgage rates just hit their lowest point in over a year, and if you’re in or around Oklahoma City, this could be one of the best opportunities we

Oklahoma City Real Estate Market Update – March 2025

🏡 Oklahoma City Real Estate Market Update – March 2025 Curious about what’s happening in the Oklahoma City housing market this spring? In this month’s real estate market update, we break down home price trends, rising inventory, faster sales activity, and what it all means if you’re thinking about

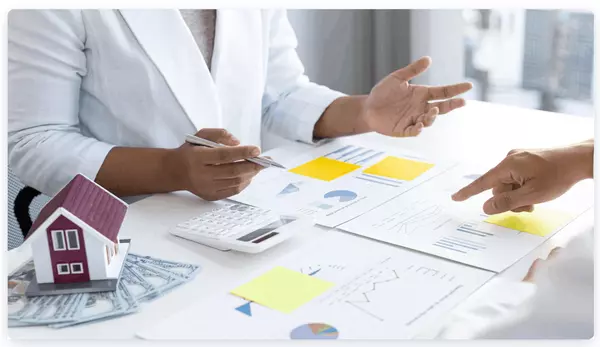

Mortgage Applications Are Rising in 2025— Here’s Why That Matters for Oklahoma City Buyers

Mortgage Applications Are Rising in 2025— Here’s Why That Matters for Oklahoma City Buyers You’ve seen the headlines: high mortgage rates, low inventory, and a challenging market for buyers and sellers alike. But beneath those surface-level stories, there’s a deeper trend playing out—one that cou

The Biggest Mistake Oklahoma City Home Sellers Make Every Spring (and How to Avoid It)

The Biggest Mistake Oklahoma City Home Sellers Make Every Spring (and How to Avoid It) It’s no secret that spring is the busiest home-selling season—but here’s what most homeowners get wrong: They wait too long. In the Oklahoma City real estate market, timing isn’t just important—it’s every

Categories

Recent Posts